TASC:2014年税收的辩护:通过减税减少公共服务的渐进式替代方案(英文版).pdf |

下载文档 |

资源简介

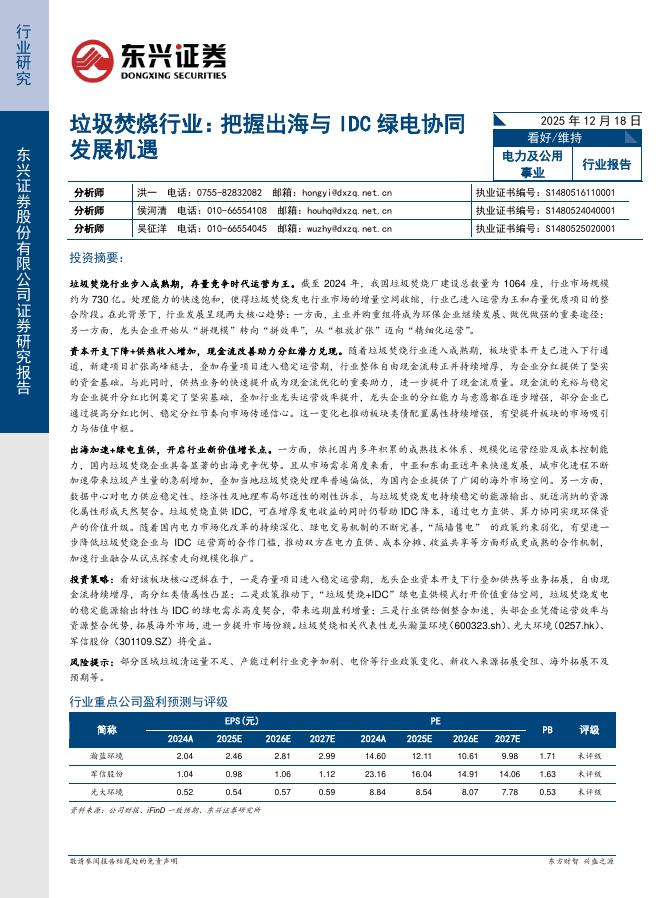

Reduce Ireland’s high level of tax reliefs. The system remains highly inequitable, benefitting higher earners and leading to a reduction in public spending. We recommend a cut to the tax break for health insurance premiums (€697.9 million in 2014) which can only benefit those who are in a position to afford health insurance in the first place, and reductions in the tax breaks given to private pensions, which cost the public finances €2,479 million in 2014. We demonstrate that the cost of tax

本文档仅能预览20页